We use cookies to make your experience better.

To comply with the new e-Privacy directive, you agree to the privacy policy and our use of cookies

Why Should Businesses Accept Credit Card Payments - Epos Direct with Integrated Payment Gateway

Why Should Businesses Accept Credit Card Payments

Operating a small business involves having a tight grasp on cash flow. For any business to flourish in today’s marketplace, it is crucial to accept credit card payments. From a Sunday market stand to a luxurious restaurant, customers expect payment choices that are swift, convenient, and secure. One strategy to facilitate cash exchange all through business is to stretch out your payment options to incorporate credit cards. Enabling customers to pay through credit cards can make handling cash flow less stressful and eliminate the setbacks of waiting for the checks to process. On the chance that your business isn't acquiring credit card instalments yet, substituting it is comparatively easier than you might presume.

Perks of Accepting Credit Card Payments

Allowing your clients to pay with Credit cards can generate many benefits for your businesses, prompting more tremendous development.

Customer convenience

Giving flexible payment alternatives that include credit card payments gives your clients a more satisfying experience, and it helps encourage loyalty. Credit card payments are very convenient for customers. On average, almost every person holds a credit card these days. The primary motive to have a credit card is its comfort. Swiping a credit card is much easier and faster than compared to paying through cash.

Improves your cash flow:

Credit card instalments are handled similarly rapidly, in contrast to checks, which typically take somewhere in the range of five and ten workdays to get through. Credit card payments are by and large cleared, and the cash shows up in your business ledger in a little while after the exchanges are done.

Helps save time:

Almost all credit cards processors enable you to accept credit card payments within a few easy clicks, saving you so much time. You won't want to go to a bank to store checks or burn through such a lot of time requesting payment for the statements.

Boost in sales:

Allowing credit card payments is an advantage that can help you draw new customers to your business, increasing your sales. If you own a company that sells commodities, taking credit card payments can enhance transactions because consumers favour paying more money while using the card.

Payment assurance:

Enabling credit card payments can determine your business has limited money in hand, reducing the risk of robbery. In spite of the fact that there are security chances while approving credit cards, in several instances, inaccurate assessments can be overcome while utilizing a merchant service provider.

Legitimates your business:

Credit card acceptance builds on legitimacy to your business. When clients see you accepting credit card payments, the trustworthiness of the banking institutions they believe rubs off on you. Be sure to advertise the logos of the credit cards you take where your clients can see them, for example, on your website, your storefront window, and on the cash register.

Essential for online business:

If you have an online business selling goods and services online, accepting credit cards will make it easier.

How to Accept Credit Card Payments

You will require to follow some measures if you are willing to accept credit card payments for your business.

Choose how you will accept credit card payments.

- The primary and initial step is to choose when and how to acquire credit card payments. For example, If you want to accept it.

- Online

- Utilizing a mobile card reader, or,

- In-person

The choices you prefer depending upon the type of company you operate. For example, if you own a coffee store, you may accept credit cards in-person near the checkout. You should also decide what credit cards you will or want to accept.

Picking a payment processing system

If a customer proceeds to pay with a credit card, there will be more to it than just swiping the card. The client’s card and account details ought to be analyzed and processed electronically to approve the payment to you. Everything happens digitally behind the picture within seconds, but you need a payment processor to operate it.

If you are willing to accept credit card payments, do it through; merchant accounts or payment service providers. A merchant account is when you open an account with a bank to take credit card payments. Payment service providers let you accept credit card payments without setting up a merchant account.

Between the two, a payment service provider may price lower processing and transaction charges. So it might turn out well for you on the off chance that you have a more current business or moderately little credit card payment values. But if you do a considerable volume of sales from credit cards, next, a merchant account could be a more straightforward way to handle your credit card payments.

Software and hardware:

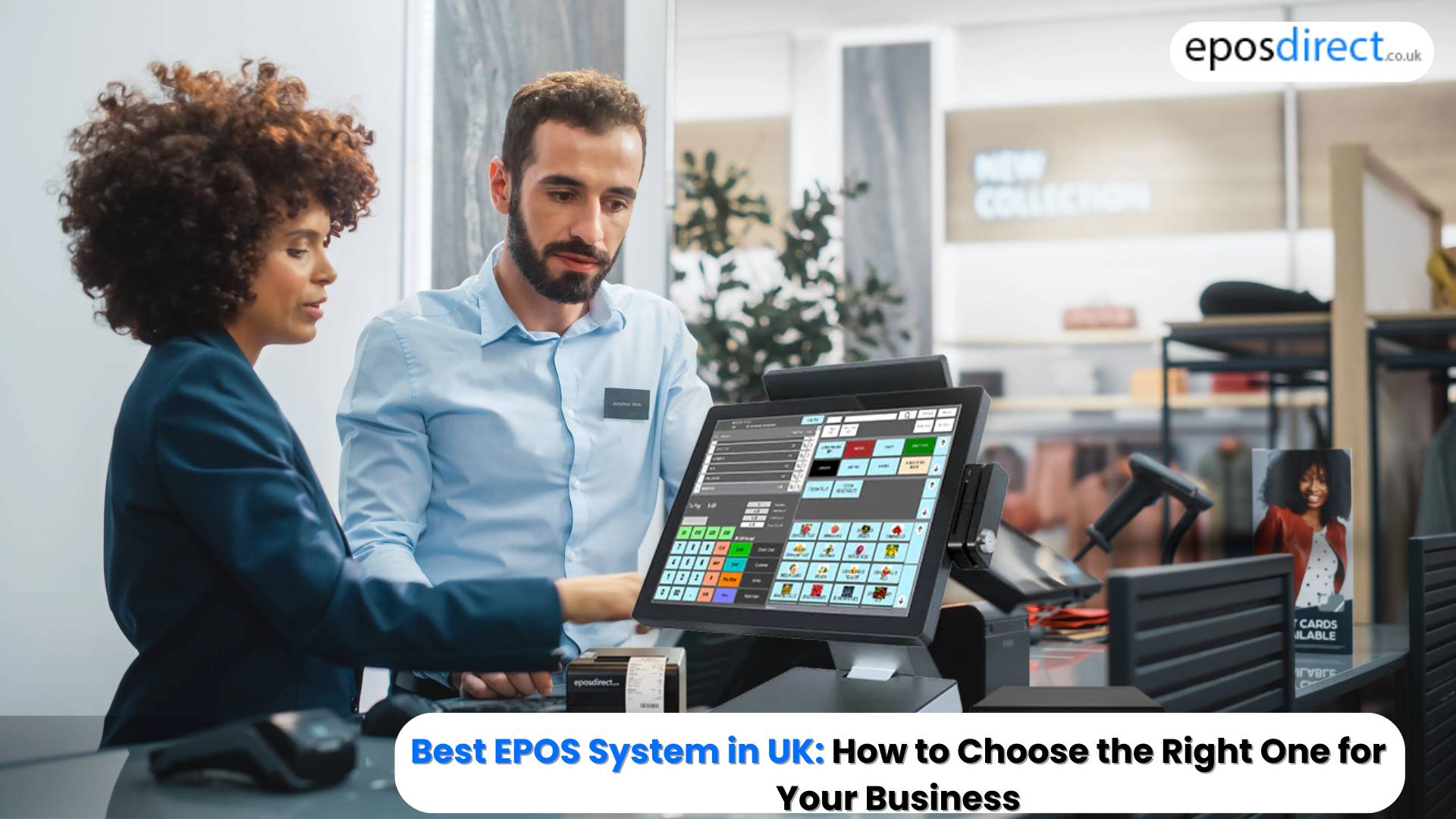

Get your credit card payment in place. Once processing credit card payments are made, you need to update your Epos system to allow your epos software and hardware to accept them. An Electronic Point of Sale (EPOS) system will enable you to accept card payments at the point of sale. The best epos system track stock, watch sales and give a seamless consumer experience. The epos system has hardware components that allow you to take card payments, such as the screen you use to make transactions, a printer that prints your receipts, etc. And software components such as management of inventory, Employee Information, etc.

Cost to accept credit cards. These credit cards come with several charges like interchange rates, transaction fees, compliance factors, cancellations, and also other fees. Credit card transaction fees are directed by the processor when a business accepts a credit card payment. The transaction fee is a flat rate charged every time a business provides a credit card payment. The fees, nonetheless, are reasonable overall.

If the costs are proceeding to take a severe bite out of your profits, you might neutralize it by increasing costs for your products or services. Either you could add on a surtax or service fee for processing credit card transactions under a particular pound amount. However, be aware of state and federal laws on credit card surcharges to dodge some illegal practices.